Building a solid credit score is a key step towards achieving your financial goals, from borrowing money to renting a home. And if you’re like most people, you wish your credit score could be higher. However, most people don’t know how to improve their credit score (besides just paying their bills on time.) Is there a better answer?

If your score isn't where you'd like it to be, Homebody is here to help. We’ll take a look at some effective strategies to boost your credit score, what your credit score actually says about your financial status to potential lenders, and much more. And we'll include actionable steps you can take to start improving your score right now.

Last, we’ll include a FAQ to answer any other questions you may have about your credit score and related topics. Let’s dive in!

Your credit score reflects your ability to borrow money and repay debts. As your credit scores increase, lenders view you as a responsible borrower. For instance, FICO considers a perfect score to be 850.

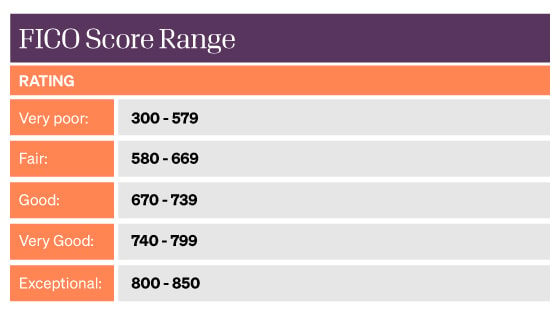

However, a “good” FICO credit score ranges from 670 - 739– achievable for many people through smart financial decision making. Here’s a reference to see how you currently stack up and how you can improve:

FICO score range

300 - 579: Very poor

580 - 669: Fair

670 - 739: Good

740 - 799: Very Good

800 - 850: Exceptional

Having a good credit score comes with benefits like better loan terms, lower interest rates, and a smoother approval process, which can lead to significant savings (of both time and money) over your lifetime.

There are also some lesser-known benefits to a good credit score. For example, some employers review your credit score during the hiring process to determine if you’re a good fit for their company. The same goes for landlords who want to ensure that you’ll be able to make rent each month. For these two instances (and many more that you may not be even aware of,) your credit score is a very important part of your future–financially and otherwise!

If you’re reading this guide, chances are that your credit score isn’t exactly where you want it to be. Thankfully, there are efficient ways to boost your credit score, many of which can be accomplished within a week or a month. Other steps can yield quick improvements in your credit score within a single day.

The key to improving your credit score is to enhance your credit history. Yet, there are other crucial actions that anyone can take to enhance their credit score.

In the next section, you’ll learn about strategies that can help you achieve good credit.

Ready to improve your credit? Jumpstart your journey towards a better credit score by taking the following steps:

Use this list as a quick reference for credit building actions and watch your scores increase. Now, let’s dive a little deeper into each one of the steps above.

Reviewing your credit report is a crucial step towards maintaining a healthy credit score. Errors on your report can negatively impact your creditworthiness. By regularly checking your credit reports from all three major credit bureaus, you can identify inaccuracies, such as incorrect accounts or missed payments. Disputing these errors can lead to their correction, potentially boosting your credit score.

This practice also helps you stay informed about your financial standing and gives you the opportunity to address any issues promptly, ensuring that your credit report accurately reflects your credit history.

Disputing credit report errors is an essential part of credit management. Inaccurate information on your credit report can lower your credit score and affect your ability to secure loans or favorable interest rates.

When you spot errors, such as accounts that don't belong to you or incorrect payment statuses, you should take immediate action to dispute them with the credit reporting agencies. You’ll find most of the contact information on the credit report, making it easy to call or email to resolve any issues. By providing documentation and evidence of the inaccuracies, you can have these errors corrected, leading to an improved and more accurate credit report.

Pro Tip: Make sure to follow up on any errors that you’ve resolved. If the company was negligent enough to have an error in the first place, chances are good that they may not report the necessary changes to credit agencies.

As one of the most important responsibilities you have to become more creditworthy, clearing outstanding debts can significantly impact your credit score. Lenders assess your creditworthiness based on your ability to manage debt responsibly.

By making timely payments and reducing or eliminating existing debts, you demonstrate your commitment to meeting your financial obligations. This positive behavior can lead to an improved credit score over time. Plus, it just feels good to not have lingering debts hanging above your head!

While it may take effort and budgeting, paying off debts showcases your financial responsibility and can open doors to better borrowing opportunities.

Maintaining low credit card balances is a fundamental strategy for maintaining a healthy credit score. Your credit utilization ratio, which measures your credit card balances relative to your credit limits, plays a significant role in your score.

By keeping your balances low, you lower this ratio, signaling to creditors that you are using credit responsibly and not overly reliant on available credit.

To do so, consider paying more than the minimum balance–you’ll be paying down the principal quicker AND reduce the overall amount of interest. This practice can positively impact your credit score and increase your chances of being approved for loans and credit in the future.

The length of your credit history is an important factor in your credit score calculation. Closing old accounts can shorten the average age of your accounts, potentially lowering your score.

Even if you're not actively using certain credit accounts, keeping them open demonstrates a longer credit history, which is viewed positively by lenders. These older accounts contribute to the overall health of your credit profile and can help maintain a strong credit score over time.

Consistently paying your bills on time is one of the most impactful ways to improve and maintain a good credit score. Late payments can significantly lower your score and signal to creditors that you may be struggling financially. On-time bill payments, including credit card payments, utility bills, and loans, demonstrate your reliability and financial responsibility.

Of course, this begs the question: How do I make timely bill payments to improve my credit? There are a number of approaches: Setting up reminders, automating payments, and budgeting effectively can all contribute to a history of timely payments, leading to a positive credit score trajectory.

Building a strong credit file involves strategically managing various credit types. Lenders consider your ability to handle different forms of credit, such as credit cards, mortgages, and personal loans, when evaluating your creditworthiness.

A combination of installment loans, revolving credit (like credit cards), and other types of credit can positively affect your credit score. This diversity provides insights into your credit management skills and financial stability. However, it's important to manage each type of credit responsibly and make payments on time to ensure that your credit score benefits from this mix.

Each new credit application triggers a “hard inquiry” on your credit report, which can slightly lower your credit score. Multiple hard inquiries within a short period can raise concerns for lenders, as it may indicate a higher risk of taking on more debt.

To maintain a healthy credit score, limit new credit applications and only apply for credit when necessary. Focus on quality over quantity, and be mindful of how each application may impact your creditworthiness.

For individuals looking to establish or rebuild credit, credit-builder loans can be a valuable tool. These loans are designed to help you demonstrate responsible borrowing behavior.

Here’s how they work: You borrow a small amount and make regular payments over a set period. As you make on-time payments, your positive payment history is reported to credit bureaus, contributing to an improved credit score.

Credit-builder loans are a constructive way to gradually enhance your credit profile, especially if you have limited credit history or past credit challenges.

Strategically paying off credit card balances can lead to improved credit utilization and a healthier credit score. Focus on paying down higher-interest cards first to save money on interest and lower your overall credit utilization ratio.

By prioritizing paying off credit cards with the highest balances or interest rates, you can effectively manage your debt and positively impact your creditworthiness. If you need help, speaking with a financial advisor can help create a winning roadmap to rehabilitating your credit score.

Requesting a higher credit limit on your existing credit cards can improve your credit utilization ratio, as long as you maintain low balances. A higher limit means your current balances represent a smaller percentage of your available credit, which can have a positive impact on your credit score.

However, there is a catch: Ensure that requesting a credit limit increase won't tempt you to overspend and that you have a track record of responsible credit management. If available credit got you into trouble in the first place, you may want to start with other methods in this guide to avoid digging your credit in even deeper.

Your credit utilization ratio, or the percentage of your credit limit you're using, is a crucial factor in your credit score calculation. Keeping this ratio low—typically below 30%—can positively affect your score. This means that if you have an available credit limit of $2,000 across credit cards, for example, you’ll want to keep it below $600 at the end of each month.

How do you keep your credit utilization ratio low? Responsible credit card use, paying off balances in full or maintaining low balances, demonstrates your ability to manage credit responsibly and can lead to an improved credit score.

While we mentioned reviewing your credit report as the key to improving your credit score, you should be monitoring your credit score regularly to stay informed about your credit health. If you see an improvement, you know that you’re doing something right. If you see a dip, you may want to check your credit report.

However, you don’t need to check your credit report (available for free 3x a year through each of the credit reporting agencies: Transunion, Experian, and Equifax). Instead, many banks team up with these agencies and provide an estimated credit score when you check your balance through online banking portals. If your bank doesn’t offer this service, you may want to open an account with a bank that does to really hone in on improving your creditworthiness.

Do you have no credit history or a bad track record? If so, a secured credit card can be a valuable tool for building a thin credit file or rebuilding damaged credit.

With a secured card, you provide a security deposit as collateral, which becomes your credit limit. Responsible use of the card, including making on-time payments, can help establish a positive credit history. Over time, demonstrating creditworthy behavior with a secured card can lead to improved credit scores and pave the way for unsecured credit opportunities.

Homebody understands the power of on-time rent payments and their impact on your creditworthiness. With Rent Credit Reporting, a modest monthly fee ensures that your timely rent payments are reported to credit bureaus. It's a simple yet potent way to repair your credit and open doors to better financial opportunities.

But that's not all. Homebody offers a smart solution that improves your credit score while you continue paying rent, something you're already doing. Say goodbye to shelling out $1,000 for a deposit – our innovative Deposit Alternative lets you pay affordable insurance premiums (around $10/month), saving you hundreds in upfront costs.

Beyond credit repair, Homebody enhances your overall financial wellness. We offer Renters Insurance with a hassle-free signup process – just about 7 clicks, taking less than 5 minutes. What's more, with Homebody you can ensure you're covered from the day you move in.

Join Homebody today and experience a comprehensive approach to improving your finances, from repairing your credit to securing your living space effortlessly.

If you want to really get into the nuts and bolts of how your credit score is calculated, we'll shine some light on what factors affect your score, how much they affect your score by percentage (“weight”), and what each term really means.

Payment history - 35%

Your track record of paying debts on time. Late payments can negatively impact this.

Credit utilization - 30%

This refers to how much of your available credit you're using. A lower percentage can mean a higher score.

Length of credit history - 15%

This looks at the age of your oldest account, the age of your newest account, and an average of all accounts.

Types of credit in use - 10%

Having a mix of account types, like credit cards, retail accounts, and installment loans, can be beneficial.

New credit - 10%

Opening several credit accounts in a short period can represent greater risk, especially for people with short credit histories.

There's no fixed timeline for credit score improvement. The speed at which your credit score improves depends on your individual situation and the specific reasons for your low credit score. However, you can see results in as little as a few weeks to a month if you’re dedicated to cleaning your credit and making the right decisions.

At least once a year. You're entitled to a free report every year from each of the three major credit bureaus.

Contact the respective credit bureau and provide them with evidence supporting your claim. They're obligated to investigate within 30 days.

No, checking your own score is considered a soft inquiry and doesn't affect the score.

Follow the suggestions in this guide and by signing up with Homebody to streamline your finances, including insurance policies, security deposit alternatives, and much more.

The fastest way to increase your credit score is by consistently making on-time payments and keeping your credit card balances low. Additionally, regularly monitoring your credit reports for errors and maintaining a mix of different types of credit can help improve your score over time.

Paying off collections doesn't necessarily increase your credit score, as the record of your debts may still remain on your credit report for up to seven years. Some newer credit scoring models, however, do not penalize you for paid-off collections.

Obtaining a new credit card can have both positive and negative effects on your credit. While it might improve your credit mix and increase your credit utilization percentage, it also generates a hard inquiry on your accounts, which could temporarily lower your credit score. If you’re at risk of lowering your credit before a major purchase, it’s highly advised that you wait until you’re approved before getting any new lines of credit.

While improving your credit score requires time and diligence, the benefits of a higher score are beyond worth it. Whether you're aiming for a new home, car, or personal loan, a better score ensures you get the best terms possible.

Trust in Homebody to guide you through your financial journey. Discover the secrets to optimizing your credit score with Homebody and unlock your potential for a brighter financial future.